Maximizing ROI: Choosing the Best Bitcoin Mining Hardware

Understanding the Basics of Bitcoin Mining

Bitcoin mining is the backbone of the Bitcoin network, responsible for validating transactions and creating new bitcoins. At its core, mining involves solving complex mathematical problems, which requires substantial computational power. The hardware you choose plays a crucial role in determining your success and profitability in this venture.

The Importance of ROI in Bitcoin Mining

Return on Investment (ROI) is a critical factor when investing in bitcoin mining hardware. With the volatile nature of cryptocurrency, maximizing ROI ensures that your investment is worthwhile. The right hardware can significantly reduce operational costs and increase efficiency, leading to higher profits.

Before purchasing any equipment, it’s essential to evaluate the initial cost, energy consumption, hash rate, and longevity of the hardware. These elements directly impact your ROI and can mean the difference between a profitable operation and a financial loss.

Types of Bitcoin Mining Hardware

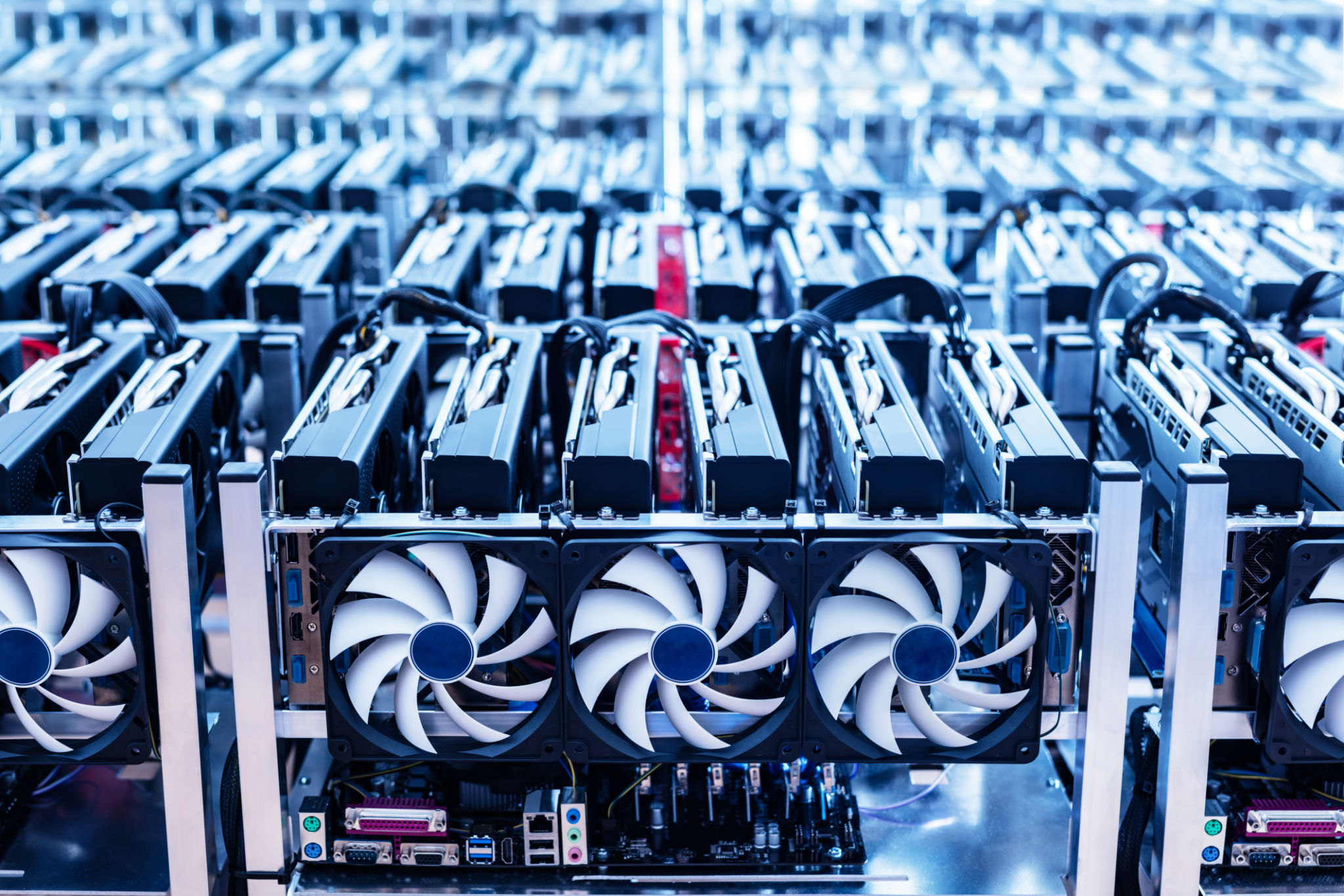

There are several types of bitcoin mining hardware available, each with its advantages and disadvantages. The three primary categories include:

- CPU Mining: This method uses standard computer processors. It's generally slow and not very profitable due to its low hash rate.

- GPU Mining: Graphics Processing Units provide better performance than CPUs but still struggle to deliver significant profits.

- ASIC Mining: Application-Specific Integrated Circuits are custom-built for mining and offer the highest efficiency and profitability.

Evaluating Mining Hardware Performance

When choosing mining hardware, it’s crucial to consider performance metrics such as hash rate and power efficiency. The hash rate indicates how many calculations your hardware can perform per second, directly affecting your ability to mine bitcoins. Higher hash rates usually translate into better mining results.

Power efficiency is equally important. Since mining is energy-intensive, choosing hardware that delivers maximum performance while consuming minimal energy can substantially increase your ROI. This balance between power consumption and processing power is key to maintaining profitability.

Cost Considerations and Budgeting

Investing in bitcoin mining hardware requires careful budgeting. While it might be tempting to purchase the most powerful equipment available, it’s essential to align your investment with your financial capacity and expected returns. High-end models come with a hefty price tag but offer better efficiency and longer-term benefits.

Future-Proofing Your Investment

The cryptocurrency market is ever-evolving, with technological advancements occurring rapidly. To ensure your investment remains profitable over time, consider future-proofing your hardware choices. Investing in equipment that can handle software updates and new protocols will help sustain operations in the long run.

Additionally, staying informed about market trends and technological developments will aid in making informed decisions about when to upgrade or replace your hardware.

Conclusion: Making Informed Decisions

Choosing the best bitcoin mining hardware requires a thorough understanding of your needs, budget, and market dynamics. By focusing on ROI, evaluating performance metrics, and considering future developments, you can optimize your mining operations for maximum profitability.

Remember that successful bitcoin mining is not just about having the best equipment but also about strategic planning and continuous adaptation to market changes.